SC SC1065 K-1 2021-2024 free printable template

Show details

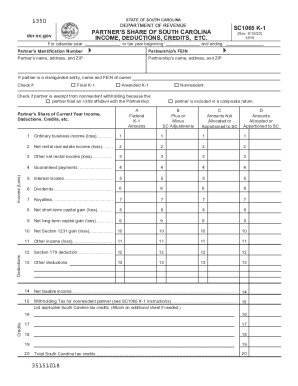

STATE OF SOUTH CAROLINA1350DEPARTMENT OF REVENUEPARTNER'S SHARE OF SOUTH CAROLINA

INCOME, DEDUCTIONS, CREDITS, ETC.for.SC.gov

For calendar year or tax year beginningSC1065 K1

(Rev. 9/29/21)

3515and

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your sc1065 k 1 2021-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc1065 k 1 2021-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sc1065 k 1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sc 1065 sch k 1 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

SC SC1065 K-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sc1065 k 1 2021-2024

How to fill out sc 1065 k 1:

01

Gather all necessary information and documentation related to the partnership and its activities.

02

Start by entering the partnership's name, address, and employer identification number (EIN) at the top of the form.

03

Provide a description of the principal business activity of the partnership.

04

Report the partner's share of income, deductions, and credits from the partnership.

05

Use Schedule K-1 to report the partner's distributive share of the partnership's ordinary business income or loss, rental real estate income or loss, and other types of income or loss.

06

Enter the partner's share of any separately stated items such as interest income, capital gains or losses, and charitable contributions.

07

Include the partner's share of any credits or deductions related to the partnership's activities.

08

Calculate the partner's ending capital account balance and report it on the form.

09

Attach Schedule K-1 to the partnership's tax return and provide each partner with a copy of their individual Schedule K-1 form.

Who needs sc 1065 k 1:

01

Partnerships that are required to file Form 1065, U.S. Return of Partnership Income, need to complete Schedule K-1.

02

Each partner in the partnership also needs a copy of Schedule K-1 to report their share of the partnership's income, deductions, and credits on their own individual tax returns.

03

Partnerships with multiple partners or complex financial activities often rely on Schedule K-1 to accurately allocate and report each partner's share of the partnership's income and losses.

Fill sc k 1 share income : Try Risk Free

People Also Ask about sc1065 k 1

What is an SC K 1?

Does South Carolina allow consolidated returns?

Do I have to renew my LLC every year in South Carolina?

Does SC require an annual report?

Does South Carolina require Cl 1?

Who is responsible for filing of the partnership return?

Is South Carolina accepting state tax returns?

Who must file a SC corporate tax return?

Who must file South Carolina partnership return?

What is the CL-1 form?

Is the state of SC accepting tax returns?

Who must file a South Carolina tax return?

What is SC1065?

Does South Carolina have a pass through entity tax?

Does South Carolina allow composite return?

Who can file a South Carolina composite return?

Can you file a consolidated S corp return?

Does North Carolina allow consolidated returns?

Do I need a cl1?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file sc 1065 k 1?

Generally, any partner in a partnership is required to file a Schedule K-1 (Form 1065) with the IRS. The partnership must also provide a copy of the form to each partner.

How to fill out sc 1065 k 1?

1. Begin by entering the partnership's name and federal employer identification number (FEIN) at the top of the form.

2. Enter the partner's name, address, and taxpayer identification number (TIN).

3. Enter the partner's share of income, deductions, credits, etc. from the partnership's Form 1065.

4. Enter the partner's share of the partnership's distributive income, deductions, credits, etc. from the partnership's Form 1065.

5. Enter any additional information required, such as the partner's share of the partnership's net income from certain passive activities, income or loss from a qualified joint venture, or other special items.

6. Enter the partner's share of the partnership's credits, including the foreign tax credit, research credit, general business credit, etc.

7. Enter the partner's share of the partnership's capital gains, losses, and/or capital gain distributions.

8. Enter the partner's share of the partnership's other items, such as the partner's share of charitable contributions, depreciation, depletion, etc.

9. Enter the partner's share of the partnership's adjustments to income, such as the deduction for one-half of self-employment taxes, the deduction for health insurance premiums for self-employed individuals, the deduction for contributions to qualified retirement plans, etc.

10. Enter any additional information required, such as the partner's share of the partnership's depletion allowance or the partner's share of the partnership's nonrecourse liabilities.

11. Total the partner's share of income, deductions, credits, etc. and enter the total on the appropriate line.

12. Sign and date the form.

What information must be reported on sc 1065 k 1?

The information that must be reported on a Schedule K-1 of Form 1065 includes:

1. Each partner’s share of the partnership’s income, deductions, credits, etc.

2. Each partner’s share of the partnership’s separately stated items, such as guaranteed payments, charitable contributions, etc.

3. Any debt forgiveness income allocated to the partners.

4. Any foreign taxes paid by the partnership.

5. Any distributions made to the partners from the partnership.

6. Any basis adjustments for the partner’s interest in the partnership.

7. Any non-separately stated income or loss allocated to the partners.

8. Any tax-exempt income allocated to the partners.

9. Any capital gains or losses allocated to the partners.

10. Any section 179 deductions allocated to the partners.

11. Any passive activity credits allocated to the partners.

12. Any other items of income, gain, loss, deduction, or credit allocated to the partners.

What is the penalty for the late filing of sc 1065 k 1?

The penalty for the late filing of Form 1065 K-1 is $195 per partner per month, up to 12 months, or $2,340 for the entire year.

What is sc 1065 k 1?

SC-1065 K-1 refers to Schedule K-1, which is a tax document used by partnerships to report each partner's share of the partnership's income, deductions, credits, and other information. It is generated as part of Form 1065, which is the U.S. Return of Partnership Income. The K-1 form is provided to each partner, who then includes the information on their individual tax returns.

What is the purpose of sc 1065 k 1?

The purpose of Schedule K-1 (Form 1065) is to report a partner's share of income, deductions, and credits from a partnership. It is submitted by partnerships filing a U.S. tax return on IRS Form 1065. The K-1 form provides detailed information about each partner's share in the partnership's financial activities for the tax year. Partnerships use Schedule K-1 to report the amounts allocated to each partner, which they will then include on their individual tax returns (Form 1040) to report their share of partnership income or loss.

When is the deadline to file sc 1065 k 1 in 2023?

The deadline for filing Form 1065, which includes Schedule K-1, for the tax year 2022 would typically be March 15th, 2023. However, it's important to note that tax deadlines can vary from year to year, so it's always recommended to check the official IRS website or consult a tax professional for the most up-to-date information.

How do I modify my sc1065 k 1 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your sc 1065 sch k 1 form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I modify sc1065 k1 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your sc 1065 k 1 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I edit south carolina sc1065 k 1 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing sc1065 k 1 field form, you need to install and log in to the app.

Fill out your sc1065 k 1 2021-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

sc1065 k1 is not the form you're looking for?Search for another form here.

Keywords relevant to sc partner share deductions credits form

Related to sc1065 2021

If you believe that this page should be taken down, please follow our DMCA take down process

here

.